Tom Brady and the New England Patriots are more than star quarterback and Super Bowl championship team. They are brands – Brady as an individual and the Patriots as an organization and corporation.

So what happens to those brands, individually and within the context of a corporate brand, when they are the subject of intense negative publicity such as the "deflategate" controversy?

TrustedPeer Experts are top-of-field business consultants who have worked with companies across a broad range of challenges. We asked them for their thoughts about lessons learned from Tom Brady and the New England Patriots.

Their answers reflect some of the same dividing lines that have appeared in fan and public reaction to the story, including geographic proximity, the willingness of constituencies to "forgive and forget," and the very nature of celebrity itself.

STEVE POTTER, managing partner, Odgers Berndtson, LLC:

Personal brand is just like a corporate brand: It takes a long time to build up and only a few minutes to destroy.

On the corporate side, you can always fire the people who screwed up and recover over time.

On the personal side, it’s a bit hard to fire yourself. So the script there is to apologize, admit wrongdoing, and do a lot of charity work for years… and hope the public forgives or forgets. They have forgiven Bill Clinton but not Pete Rose. Go figure!

DAVID WARD, CEO, Telegraph Hill Program Initiatives:

Sport franchise brands like the Patriots and the brands of individual stars like Brady are all about winning. Fair play is secondary, and pushing the boundaries of the rules is expected – "just win baby." Inasmuch as Patriots fans want and expect Brady and the Pats to win, and they did, I don't think the current episode will be remembered much or tarnish their brands.

In my industry, technology, I compare this situation to the Microsoft antitrust case of the 90s and continuing into the 00s under Gates: Is the Bill Gates "brand" much diminished by they way he pushed his business practices beyond the edge of customary competition? He is still the richest man who ever lived (i.e., still winning, brand intact). Microsoft's brand was tarnished by the decade-long stock price slump after Ballmer took over (not winning, brand diminished). Only recently do we see that brand starting to revive under Satya Nadella, and we'll soon see if he's a winner.

In my opinion, this Pats/Brady episode (like similar ones in the MLB and NBA) is more about a regulatory agency (the NFL) proving its oversight bona fides so it can justify its own brand image – not to mention its exemptions from antitrust scrutiny

RUTHY BENNETT, regional energy manager, Towns of Arlington and Bedford, MA:

Tom Brady is a brand. He is what Ralph Lauren was looking for, what Tommy Hilfiger tried to advertise for. Brady is All-American – wholesome and strong. His beautiful wife and children did not hurt, but he himself created his brand – hard-working, team member, involved in the community and yes, very good-looking. The Patriots were no fools when they stood behind him. He has become them.

His parents have built the same brand. They live in California in the same house Tom grew up in. No gates, no gold-plated faucets, no mansions...

Brady told Bob Kraft a long time ago that drafting him was the best thing the Patriots could have done. He was confident and he also proved his worth. Patriot fans love, love, love Tom Brady. Facebook is awash in love for him on the New England side of the country. The Patriots were brilliant in changing their FB cover photo to his jersey. I shudder to think of the roar in the stadium when he plays his first game in the 2015-16 season. I bet the price for those tickets could rival Super Bowl ticket prices.

The Pats let Belichick be the ugly guy – literally and figuratively. He is smart but gruff, rude to the press and barely smiles. He wears worn-out clothing (have you see how Giselle dresses Tom?). He is like a rodent – ferreting out every obscure rule to use in his offensive plays (for example, switching eligibility right before a play starts). Belichick is the one who people love to hate and he brings it on. Brady gets to be the superstar without trying to take the limelight. The Pats set it up well.

What has hurt the NFL and has helped the Patriots is that whether Brady was/is guilty or not, he stayed true to his brand – hard-working, clean-cut, friendly and a team player. He spoke to the media with a smile in "hard-working" clothes (sweaty shirt interview during deflategate as opposed to his very designer outfits on most other occasions). He kept his head down. He did not lose his cool, he did not mouth off.

In fact, part of the Patriots brand is the opposite of the Oakland Raiders. You'd be happy to have any of these guys meet your mother. Belichick and Kraft run a very tight ship. There are no bottle caps at Gillette Stadium. If you buy a water bottle, they take it off for you – so there's nothing to throw. There is a "family" section, and you can text the stadium if someone is cursing, drunk or otherwise bothering you. Clean-cut, family-friendly, hard-working and in the end – major major winners.

I can't wait to read the college and master's papers written about this "gate." I bet there will be more on this topic than for Chris Christie's George Washington Bridge "gate."

DAN BEEBE, president, Dan Beebe Group:

In the sports world, there is a continual balance that has to be struck between the club or league brand and those coaches and players who become successful and revered. It presents a big risk if the individual(s) become bigger than the university, professional club or league.

As a former NCAA investigator, I also saw situations where those in more vulnerable positions would not be forthcoming about the misconduct of the powerful because of the risk it posed to their livelihoods and future. Look what happened at Penn State.

JONATHAN DANN, president, Jon Dann Communications:

Personal branding (within the context of a corporate brand) has become much more fragile and ephemeral in the present era – resulting in less value and ROI.

The very notion of celebrity has changed dramatically. In the old days, someone achieved fame for an accomplishment or heroic deed. In the age of the Internet, celebrity has been turned on its head.

People all too often achieve their fame through bad behavior or pushing societal boundaries. This phenomenon has never happened before.

In the Internet era, the politics of personal destruction (coupled with a lack of personal privacy) are particularly vicious so that even those who have achieved fame through honest achievement find themselves under attack.

The result: a diminished personal brand.

The above does not suggest that personal branding lacks value, only that tying a corporate brand closely with a personal brand must be much more closely scrutinized before entering into a partnership with a celebrity.

JOHN PHILLIPS, president, Colony Marketing:

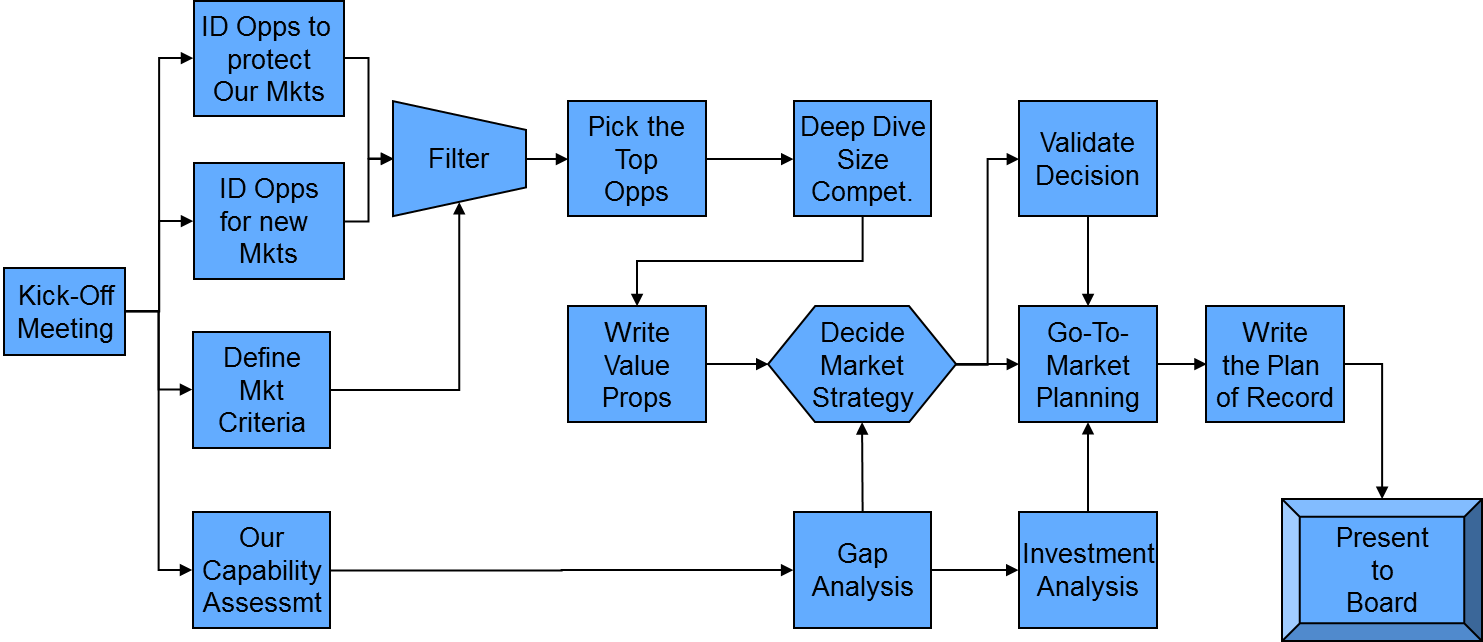

In the case of Tom Brady and the Patriots, think of the Patriots as an umbrella brand and Brady as a sub-brand.

Two criteria for good sub-branding:

Umbrella brands and sub-brands need to be aligned in terms of their promise, visual identity, etc.

There should be a clearly defined sub-brand strategy and architecture.

As a New York sports fan, I find there is no branding issue in this case. Unsportsmanlike conduct is a tightly-aligned promise between umbrella brand and sub-brand.

KATE MONTGOMERY, TrustedPeer editor and former marketing executive at the Wall Street Journal:

Interesting topic. I'm actually exploring something related to your personal brand question for a book project I've recently started.

Regarding Brady, I'm not following "deflategate" too closely, but it seems he was suspended because he knew the ball was deflated, yet said nothing. It is likewise another example of a group of people we would like to admire who are caught cheating in order to "win" a big prize. No longer an unusual event, unfortunately.

Of course, there are exceptions to this rule. Video games are an example with which I have extensive experience from my time at EA. The occasional success of sequel products in this arena is in part because the original games helped build the market to its current size. Initially, video gaming was a smaller business, but as console gaming advanced and early fans became advocates, the audience and revenues grew, as did the audience’s age!

Of course, there are exceptions to this rule. Video games are an example with which I have extensive experience from my time at EA. The occasional success of sequel products in this arena is in part because the original games helped build the market to its current size. Initially, video gaming was a smaller business, but as console gaming advanced and early fans became advocates, the audience and revenues grew, as did the audience’s age!  2. If a line extension is a product improvement: This often occurs when technology advances after the release of the original product. To prevent being eclipsed by late entrants who can leverage the newer technology, a company can offer their own advanced version. Though the new product may replace the original on consumers’ lists, it also prevents the loss of overall share – and boosts reputation, by demonstrating innovation as a company value. (Don’t undervalue this attribute!). One example was the emergence of microwave ovens and the release of Orville Redenbacher’s Microwave Popcorn®. That could be an example where the new extension actually drove the technology; if you don’t believe me, check your microwave and see if there is a “Popcorn” setting!

2. If a line extension is a product improvement: This often occurs when technology advances after the release of the original product. To prevent being eclipsed by late entrants who can leverage the newer technology, a company can offer their own advanced version. Though the new product may replace the original on consumers’ lists, it also prevents the loss of overall share – and boosts reputation, by demonstrating innovation as a company value. (Don’t undervalue this attribute!). One example was the emergence of microwave ovens and the release of Orville Redenbacher’s Microwave Popcorn®. That could be an example where the new extension actually drove the technology; if you don’t believe me, check your microwave and see if there is a “Popcorn” setting!